HMRC mileage rates, rules, & process for 2024

Published on March 28, 2024

)

Setting up your company expense policy can be a complex process for finance teams. You need to figure out which expense categories to reimburse, how to keep your expense policy up to date and how to handle work related travel.

One category that often gets overlooked is company mileage allowances. Mileage allowances apply for work-related trips made by employees in their own vehicles.

So how do you define them for your company?

The good news is that a certain ‘approved amount’ of Mileage Allowance Payments, or MAPs, can be paid out without having to be reported to the tax authority, which is meant to offer an economical way for businesses to invest in the travels of their employees.

Here's how they work.

Note: this article and its mileage rates are up to date as of April 2024. This article is a guide, but should not be taken as legal or tax advice. For more information, consult your lawyer or HMRC directly.

What are HMRC mileage allowance payments?

The premise behind mileage allowance is simple: some employees use their own vehicles for business travel, and business travel expenses are normally free from tax.

So companies should be able to reimburse their employees for business expenses made in private cars free from tax. That should include not only the price of petrol, but also upkeep, and wear and tear on the car in question.

HMRC has created a scheme to simplify this matter — MAPs. Without these, companies (or HMRC itself) would need to individually quantify how much wear and tear each private car has undergone, and add this to petrol costs, road tolls, and more.

Instead, we have a flat rate to be calculated per mile.

When do trips qualify for tax-free mileage allowances?

It’s easy to know if trips can be counted against the set amount of mileage allowance that’s exempt from taxes — they just need to pass the following tests to see if they have a business character.

According to HMRC, trips are seen as business-related when:

The work can’t be done unless the trip is made

The employee needs to be somewhere other than the usual workplace to carry out the job.

Also, journeys cannot be covered by MAPs if they:

Are part of a daily commute between an office and a private residence, or any other place that’s not a permanent office

Are extremely short (just down the road, for example)

Don’t have an obvious work-related character

Are private journeys with one or two work-related stops. The primary purpose of the trip must be business.

HMRC mileage rates 2024

It doesn’t matter if you have people occasionally making a trip using their own car, or using it constantly — keeping track of their mileage can quickly get messy. Luckily, there are are very clear rules in the UK about turning MAPs into valid tax-exempt reimbursements, also known as the ‘approved amount.’

Here are the current HMRC MAP rates:

For the first 10,000 miles per tax year, cars and vans are eligible for 45p per mile. From there, travel is at a rate of 25p per mile. For motorcycles and bikes, the rates are the same for all travel — it’s always 24p for motorcycles and 20p for bikes.

If it’s still unclear, or if you have a hard time calculating how much you can save on taxes, check out HMRC's official working sheet for the right mileage allowances.

It’s important to note that if the company doesn’t cover the full ‘approved amount’, your employees can apply to get Mileage Allowance Relief for the unpaid part.

Passenger rate for business mileage expenses

Employers can provide an extra 5p per mile to drivers who carry a passenger on work trips. This only applies if the passenger is also traveling for business and is an employee of the company.

In this case, these payments are also "approved" and do not need to be reported to HMRC.

How HMRC mileage works for multiple vehicles

These rates are for the total amount traveled per employee, not per car. If the employee uses multiple cars throughout the year, you still look at their total miles traveled.

Equally, if the employee uses one car and one motorcycle, you still add the total miles traveled between the two. You will then reimburse the employee at the appropriate rate for each, based on the number of miles traveled.

Important notes on HMRC business mileage rates

Here are a few added extras to keep in mind when you calculate company mileage payments:

MAPs are designed to cover wear and tear, car insurance, and road tolls. These are built into the rates.

The rates are not designed to cover parking or VAT, but these can still be claimed where they are clearly and exclusively business travel expenses.

Employers can choose to reimburse employees at a higher rate. In this case, the excess amount will be subject to tax.

If the employer pays less than the HMRC rate, the employee can claim tax relief on the difference between the two rates.

Keeping track of company mileage allowances

Just like many other things related to taxes, you won't be able to get anything refunded from HMRC if you don't carefully log the trips you make. Keeping a mileage logbook doesn't have to be complicated, however – you just need to follow some simple rules.

All journeys need to be logged with a date, purpose (business or personal), start point, destination and total miles traveled. While HMRC doesn't require companies to file detailed logs every year, you do need to keep them for at least five years after the yearly tax submission date, as you can be requested to show them during an inspection.

If you manage a large number of employees, or your employees frequently use vehicles to travel for work, consider using a centralized platform such as Spendesk to manage mileage allowances and general travel spending.

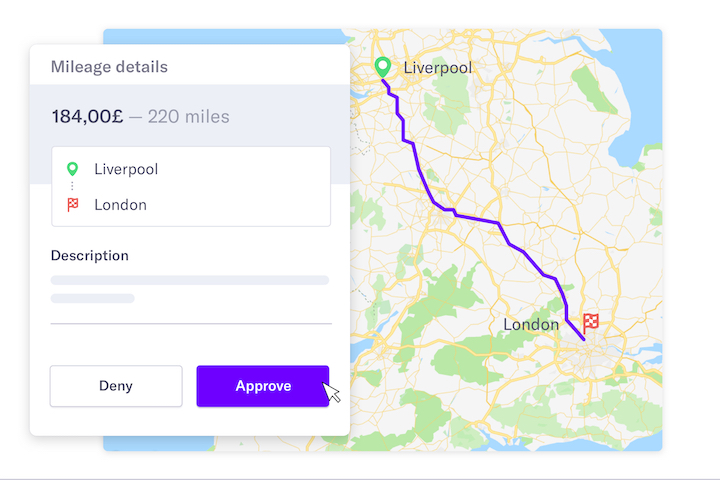

Spendesk's mileage feature in action

Spendesk's mileage feature in action

Employees save time on the road with access to smart payment methods, clear approval processes and digital tracking of receipts and mileage claims.

Back in the office, the finance team stays in control with simple payment reconciliation, integrated accounting and a real-time overview of company spending.

Want to learn more? Read about the smart ways modern CFOs easily optimise travel spending.

More articles dealing with HMRC's rules and regulations:

)

)

)